For the second time in 2019 Invast Hotels carried out the major survey into the occupancy rates and average room prices of hotels in the largest hotel cities in the Netherlands in 2018. This research provides the best insight into the regional differences of cities within the Dutch hotel market. Each city was surveyed with more than 10 hotels in order to be able to speak of a fully-fledged hotel market within a city.

In the survey Invast Hotels approached all hotels in the largest hotel cities in the Netherlands with a survey that asked for the average room price and occupancy rate of 2018. Hotels were first approached by email and if there was no response by phone. No less than 268 hotels participated with a total number of hotel rooms of 21,619. Based on the total number of hotel rooms, this represents a participation rate of 34%. This is an unprecedented high participation rate, which gives the best insight into how the Dutch hotel cities function.

Results per city

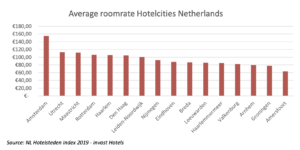

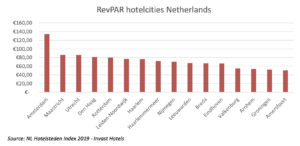

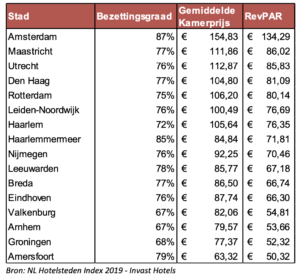

The average occupancy rate of all participating hotels in 2018 was 80.13%. The average room price was € 113.23 and the RevPAR (Revenue Per Available Room) was € 90.73. Not surprisingly, Amsterdam is the best performing city in the Netherlands, both in terms of occupancy rate and average room price. The Hague, Rotterdam, Utrecht and Maastricht will also show a high RevPAR of over € 85 in 2018.

The graph below shows the average occupancy of the largest hotel cities in the Netherlands. Delft and Zwolle have been left out of the graph as these cities had an occupancy rate of less than 20%, as a result of which these data are not considered representative by Invast Hotels.

In most of the cities an occupancy rate of between 75% and 80% is achieved. It is also noteworthy that Amersfoort will have achieved a relatively high occupancy rate in 2018. The following graph shows the average room price. This makes it clear that although Amersfoort achieves a high occupancy rate, the average room price is well below the average.

By multiplying the occupancy rate and the average room price, a RevPAR can be calculated. The graph below shows the RevPAR of the largest hotelcities in the Netherlands in 2018.

With the above graph it becomes clear why Amsterdam is often described as a separate market in the hotel business: the difference compared to other cities is very large. The other major cities in the Netherlands follow at an appropriate distance. Cities such as Haarlemmermeer, Amersfoort and Leeuwarden achieve a high occupancy rate but with a lower average room price, making these cities show an average lower RevPAR.

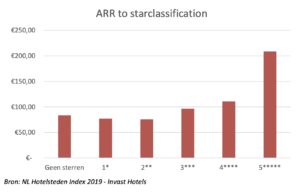

Results per star rating: 1 = 2 star rating

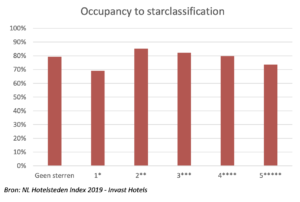

A striking result is that no significant difference in average room price can be observed between one and two star hotels. However, one-star hotels achieve a lower occupancy rate compared to two-star hotels. As expected, the occupancy rate of five star hotels is below average, but the five star hotels show a substantially higher price per room, well above €200,- per room. The tables below show the results per star rating.

Table

For hotels, participation is important to show banks, municipalities, shareholders, boards of directors what the results are of the hotel in the market where it is active. This allows for a better understanding of the risk, which can be helpful with financing or expansion opportunities within a municipality.

The table below provides a total overview of the data presented in this article for the main 16 Dutch hotel cities. Invast Hotels would like to thank all participating hoteliers and hopes for an even higher participation rate next year.

Authors: Bastiaan Driessen, Jelle Straatsma.

Invast Hotels is engaged in transactions, valuations and research in the field of Hotels and Real Estate. By doing a lot of research every year Invast Hotels makes the Dutch hotel market more transparent, which contributes to the professionalization of the hotel market in the field of financing and investments.